DEBT COLLECTION

- Telecommunications and Media

- Intellectual Property

- Tax Law

- Restructuring and Insolvency

- Public and administrative law

- Privacy and Data Protection

- Labour law and Employment

- Human Rights and ECHR

- Family Law

- Energy (including renewable)

- Debt collection

- Commercial Contracts and Projects

- Citizenship, Residency and Migration

- Banking and Finance

- Arbitration and ADR

- Mining

- Antitrust and Competition

- Real Estate and Construction

- Criminal law [defence and representation]

- Litigation and Dispute Resolution

- Corporate law and M&A

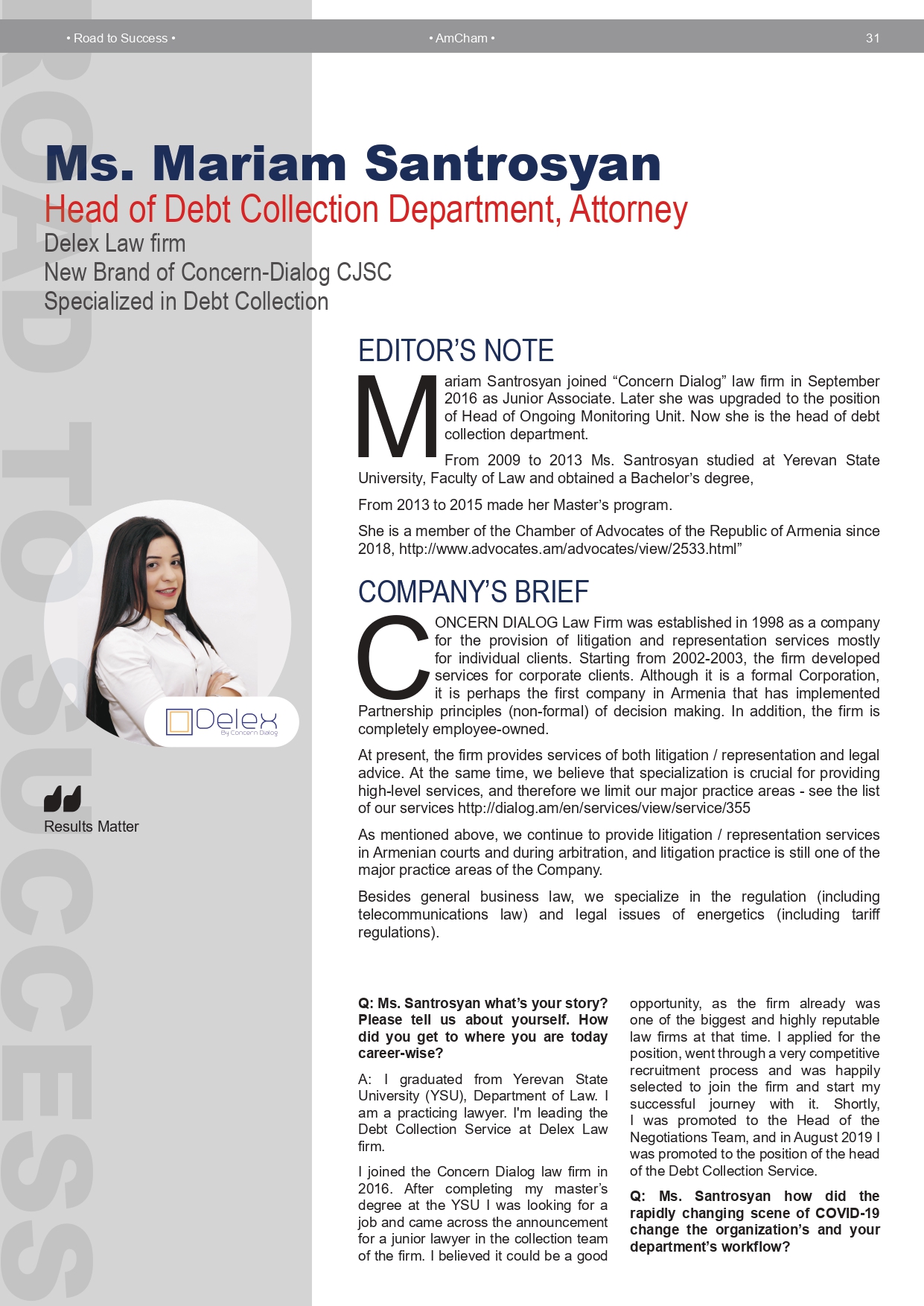

Concern Dialog law firm provides specialised debt collection services to clients since 2011. The service includes both soft collection and litigation. Since 2020 the firm has started to provide the service under a new brand - Delex.

Concern Dialog assigns teams specialised in solving specific issues, which are highly qualified lawyers, attorneys, as well as other high-quality professionals who help to undertake separate steps of the collection.

The firm operates an automated call centre and assigns groups for negotiations and concluding amicable settlements with debtors, as well as has judicial representation, enforcement and management groups.

Based on the Company’s experience accumulated over the years, the company has developed and is regularly updating management systems. Our collection team has developed unique approaches to analyse emerging problems and solve them before they become widespread (early identification and elimination).

Main clients for the debt collection service are organisations, who have a significant number of similar (standardised) current debtors, such as telecommunications operators, public service providers, banks and other financial institutions, retailers, etc.

Concern Dialog law firm also provides a separate debt collection service as part of its litigation as well as bankruptcy and restructuring practices, again applying convenient fee arrangements (usually percentage from the recovered amount).

The service is useful both for organisations that do not want to deal with debt at all, and fully outsource the function, and for organisations that want to use our services to strengthen their resources or service the accumulated large number of cases.

To process the debt collection, we provide services considering the specifics of the client's debt:

- Extrajudicial process - Debtors are informed about the debt verbally and in writing. The staff of the call centre tells and explains to the debtors the consequences of the failure to pay the debts, as well as the additional court costs in case of debt confiscation through the judicial procedure and other adverse effects, urging them to pay the existing debt. The process is carried out both at the beginning of the collection process and in later stages, when the company's employees regularly contact the debtor, urging them to pay the debt, informing them of the complications expected in the subsequent processes (for example, the risk of accounts freezing). They also offer a reconciliation option or payment schedule (if such alternatives are acceptable to the client).

- Litigation - Our lawyers submit requests to issue a payment order or claim to court. If necessary, judicial representation is provided, including submission of court documents to the Courts of Appeal and Cassation, if such processes take place. If there is an arbitration agreement, the process is organised, taking into account the specifics of the arbitration agreement.

- Enforcement Processes – we actively work with the Enforcement Service to ensure that appropriate procedures are in place, including identifying the property and imposing seizure, regardless of the debt size. Active work is being done to sell the property at auctions at the fastest and possible high price, ensuring a high rate of actual debt collection.

The pricing of the services is also unique. The client usually pays only the agreed percentage of the amount collected; that is, the amount physically transferred to their bank account. That is, as long as the client has not received the collected amount, no payments are made for service of the process, filing the lawsuit with the court or performing other services (except for the price of the state duty and similar direct costs). The percentage rate depends on the type of debt, the average amount of each case and other specifics of the debt, and it is agreed individually per product.

As a rule, Concern Dialog can provide services on more favourable terms than other market participants. The mentioned approach in the service development phase was revolutionary in the Armenian market. So far, not all organisations providing such services have switched to the principle of receiving payment based entirely on "created real value".

Depending on the “quality of debt”, including the number of days after the default, we usually manage to collect from 60-80% of the debt within two years after the transfer (for NPL30-NPL60).

.png)

1 Charents str., Office 207 Yerevan, 0025, Armenia

[email protected] +374 60 27 88 88 +374 10 57 51 211 Charents str., Office 207 Yerevan, 0025, Armenia

[email protected] +374 60 27 88 88 +374 10 57 51 21

.png)

.png)